PCI ssf

PCI-SSF

Today, with the advancement of technology and the digital revolution, almost

everything we tend to do with the employment of the internet, and also the

payment strategies have been modified in digital payment strategies.

Internet banking and banking cards are main transaction method that takes place

via online. With the advancement of recent modern payment methods, the

traditional methods of securing the software that promotes payments ought to

additionally develop.

PCI SSF is the result of all this need an array of developing phases and efforts in this direction.

Developing phase-PCI-DSS &PCI SSF

With all of these Data failures and data, theft is sadly common and negatively

influences all payments parties in several directions—from retailers to consumers

to banks—so the necessity for PCI compliance is that the greatest ever.

PCI standards for compliance are developed and conducted by the PCI Security

Standards Council and is directed by credit card corporations to assist make sure

the security of credit card transactions within the payments business.

PCI SSC initiated the Payment Application Data Security Standards (PA DSS) in the

year 2008 with the insight of securing payment applications. PA DSS helps

payment application vendors promote secure payment applications.

With growing times, the number of payment strategies started spreading, and for this to

assist the current security requirement of the payment world, PCI SSC has revealed

the PCI DSS (Payment Card Industry Data Security Standard) is a security standard

Which is developed and supported by the PCI Council and Its purpose is to assist secure and

defend the complete payment card ecosphere.

PA DSS basic and Restraints

The Payment Card Industry Data Security Standard (PCI DSS) is an information

security standard for organizations that hold branded credit cards from the major

card schemes.

The PCI Standard is directed by the card brands but executed by the Payment

Card Industry Security Standards Council. The standard was created to boost

controls and supervise cardholder data to bring down credit card fraud.

Validation of compliance is performed annually or quarterly, by a technique

appropriate to the degree of transactions handled

• Self-Assessment Questionnaire (SAQ) — smaller volumes

• external Qualified Security Assessor (QSA) — moderate volumes; associated

an Attestation on Compliance (AOC)

• firm-specific Internal Security Assessor (ISA) — larger volumes; associated

issuing a Report on Compliance (ROC)

The objectives of each were approximately similar to create an additional level of

protection for card issuers by securing that merchants meet the lowest levels of

security when they store, process, and transmit cardholder data. To examine the

integration problems among the existing standards, the combined effort made by

the principal credit card organizations yielded in the release of version 1.0 of PCI

DSS in December 2004. PCI DSS has been implemented and followed across the

globe.

The PCI Data Security Standard enumerates twelve requirements for compliance,

coordinated into six logically related groups termed

The six groups are

- Build and Maintain a Secure Network and Systems

- Protect Cardholder Data

- Maintain a Vulnerability Management Program

- Implement Strong Access Control Measures

- Frequently Monitor and Test Networks

- Manage an Information Security Policy

What are the 12 requirements of PCI DSS?

- Secure your system with firewalls

- Setup passwords and settings

- Secured stored cardholder data

- Encrypt transmission of cardholder data across open, public networks

- Use and often update anti-virus software system

- Frequently update and patch systems

- Limit access to cardholder data to business essential

- Allocate a novel ID to every user with computer access

- Restrict physical access to workplace and cardholder data

- Execute logging and log management

- Manage vulnerability scans and penetration tests

- Documentation and risk assessments

Compliance levels

All corporations which are subjected to PCI DSS standards must be PCI compliant.

These are distributed in four levels of PCI Compliance and support on the number

of processes annually, and a few other details associate with the level of risk

evaluated by payment brands.

At an upper level, the levels are as below:

• Level 1 – Over 6 million transactions annually

• Level 2 – In Between 1 and 6 million transactions annually

• Level 3 – In Between 20,000 and 1 million transactions annually

• Level 4 – Less than 20,000 transactions annually

This is mandatory that Each and every card issuer maintains their own table of

compliance levels.

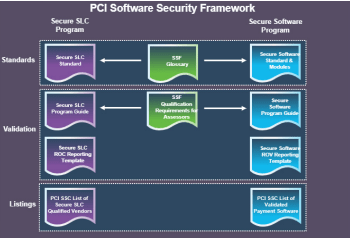

PCI-SSF - PCI SSF is an independent collection of payment security standards that includes

elements of PA DSS. SSF aided existing ways to demonstrate smart application

security and a range of new recent payment software and promoting processes.

PCI Software Security Framework versus PA-DSS?

PA DSS is developed to keep up the security of payments by supporting software

development and lifecycle management principles. As well, PA DSS includes a

precise eligibility criterion that the application enters in authorization and (or)

developed and validated as per its requirements.

swiftly evolving payment application software to fabricated various payment

methods have to objectives that are focused on security approach. This approach

must provide security for the modern payment software, minimize the

vulnerabilities, and abate cyber-attacks.

To support a wide array of payment software system sorts, technologies, and

development methods, PCI SSC declared the launching of the new PCI Software

Security Framework (SSF) in 2022. After October 2022, PCI SSC organized the

official expiration of PA DSS, the benchmark commonplace.

PCI SSF is an authoritative collection of payment security standards of design and

development of payment software that combined components of PA DSS.

It is a new replacement approach that supports both the existing and future

payment software and Its working as an extension to the PA-DSS limits to address

overall software security flexibility.

SSF established varied existing ways that to demonstrate smart application

security and different type of new payment software and development processes.

The security of payment software is a complex part of the payment transaction

flow and is crucial to support trustworthy and accurate payment transactions. - Modern software development enforced objective-focused security to support

more proficient development and update cycles than traditional software

development practices. The PCI SSF enters with evolution with an approach and

combines both traditional and modern payment software.

It is a framework established to make certain benefits fit the best of both

worlds and implement measures that best practices of secures systems

It provides vendors with security standards for promoting and sustaining payment

software so that it preserves payment transactions and data, decreasing

vulnerabilities, and protects against cyber-attacks.

The PCI SSF also combined a new 8 version of validating software security and a private secure

software lifecycle qualification for vendors with robust security promoting practices.

Secure Software Framework Assessors (SSF Assessors) estimate vendors and their

payment software products against the Secure Software Lifecycle (Secure SLC)

Standard and the Secure Software Standard. The PCI SSC records both Secure SLC

Qualified Vendors and Validated Payment Software on the Council’s website as

assets for merchants, service providers, and acquirers.

Transition from PA DSS to PCI SSF - For a smooth transition from PA DSS to PCI SSF, PCI Council will continue to Insists

PA DSS validated applications through the end of October 2022.

In their strategy, it clearly mentioned that the existing PA-DSS validated

applications will remain on the “List of Validated Payment Applications” until their

expiry dates with the assurance of not having any impact on the users.

Further, by the end of October 2022, PCI Software Security Framework will

replace PA DSS and its records.

With this transition, the payment application will be validated with PCI SSF

after the expiration of PA DSS in 2022. The new framework provides more

security and flexibility to all the software vendors and ensures a better alignment

of secure application development, as per the industry standard.

Advantages of PCI SSF Compliance

Unlike PA-DSS, the SSF will support multilevel security efforts and provide more

focus on secure design and development.

PCI SSF Compliance constitutes combined advantages of customers, vendors, and

merchants in general. - SSF Compliance provides a modular assessment architecture and approach,

designing more flexibility. - Practicing the PCI Software Security Frame will help decrease the risk

associated with penalties and Data Breach Complications. - Compliance insists appropriate security and protection mechanism are in

place to secure the card data environment. - It ensures critical assets are protected and further restores the

implementation of access controls. - It gives a guarantee that the organizations are meet up their legal

obligations. - It provides strength for the customer that the organization has kept the

efforts to secure the environment and protect their data. - Compliance to SSF means having implemented a risk management process

and having Business continuity plans in place - Compliance with SSF Framework ensures protection against emerging

security threats and acquire to any changes in the applicable regulatory

standards.

The PCI SSF Standards - PCI SSF is re-structured from the ground-up to focus on two different aspects,

which have been developed as two separate programs.

Secure Software Standard and Secure Software Lifecycle Standard.

Secure Software Standard

Validation of payment software to Secure Software Standard (S3) ensures that the

design of payment software ideally protects the integrity of the software and also

the security of sensitive data that It captures, stores, processes, and transmits. - Applicability of this customary usually includes-

Software products involved missions with direct support or forward payment transactions that

store, process, or transmit data flow. Software products developed by the vendor that are

commercially sold to multiple organizations.

Secure Software Lifecycle Standard

Validation of payment software to Secure Software Life Cycle Standard ensures

that vendor’s software development life cycle processes, operations, and

exercises are compliant with the PCI Secure SLC Standard.

Relevancy of this standard includes– - All vendors who develop payment software

Timelines

• Announcement concerning the discharge of PCI Software Security

Standards – January 2019

• PCI SSC revealed the Software Security Standards documents – June 2019

• Software Security Standards Assessor company applications are out there–

October 2019

• SSF Assessor Training available – Q1 of 2020

• SSF programs open for vendors – Q1 of 2020

• First PCI SSF program listings expected – June 2020

• Deadline for the acceptance of recent PA DSS application submission – June

2021

• PA DSS program closes and the begin of payment application validation

beneath PCI Software Security Standards Framework – October 2022

Frequently asked questions about this transition

With the program in its nativity, there are several applications to potentially get

listed within the next year and associated with an unknown range of vendors to

consider the Secure SLC validation and so many questions to be answered.

Will SSF be easier or tougher and more challenging than PA-DSS? Will this move

be costlier?

• What are changes that will impact applications?

• However, am I able to record my frequent application changes with the

Wildcards being off from the program?

• What are the advantages is there to urge the optional Secure SLC listing as

a vendor, or is it adequate to set down my software through the Software

Security Standard only?

• Is it attainable to manage the hassle and price of SSF to possess extra

business value?

• However, am I able to manage the Secure SLC program that provides value

to my development team among simply payment software development?

Final Thoughts about PCI SSF

While the transition from PA DSS to PCI SSF could seem challenging, in reality, it

won’t create a distinction or rather impact your compliance efforts. In fact, PCI

SSF provides further flexibility for software developers to include payment

application security as per the present industry-accepted practices.

furthermore, as mentioned earlier, to create it a hassle-free transition for

stakeholders, the PA-DSS and SSF Programs will run parallel with the PA-DSS

Program continued to control because it will until the date of termination

Having mentioned that, we personally feel the decision of introducing a new

replacement of framework is for the higher of society and the smart things about

the purchasers and vendors. Therefore, the introduction of PCI SSF should not be

taken otherwise and may be taken absolutely by all stakeholders.

Moving forward successfully with PCI SSF

The PCI SSC designed the SSF with a spotlight on secure software development

and a more additional versatile approach to the validation method.

This is excellent news but however, conjointly ends up in several challenges and

inquiries to advantages of PCI SSF Compliance.

Hi there to every one, as I am in fact keen of reading this webpage’s post to be

updated regularly. It consists of fastidious information.